Open enrollment for endowed benefits begins Nov. 1

By Nancy Doolittle

The benefits open enrollment period for endowed faculty and staff runs Nov. 1-30. During this time, endowed faculty and staff members can: enroll in, make changes to or drop one of the three endowed health plans; enroll in a medical or dependent care flexible spending account; and – new this year – enroll in a legal services plan.

The legal services plan covers a wide range of services, including caregiving options and elder law, contractor problems, Social Security and veterans benefits, and preparation of such legal documents as wills, revocable trusts and power-of-attorney. The plan is optional, but enrollment for 2014 must be completed between Nov. 1 and Dec. 31.

Also new this year:

- Workday online enrollment: Endowed employees need to go to Workday.cornell.edu, click on All About Me, click on the Inbox and open the Open Enrollment event to enroll in or make changes to benefits online.

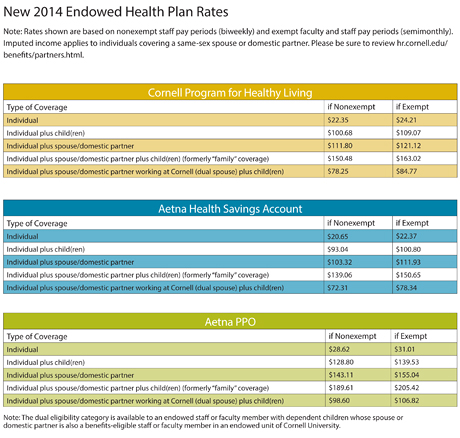

- New endowed health plan rates: Review the new rates. If you do not need to make any changes in your health plan, you do not need to re-enroll for coverage to continue in 2014.

- Enhanced dental/vision plan: An A+ plan option has been added to the dental plan with such additional benefits as dental implants, adult orthodontia and Lasik surgery.

- Personal health record: You can open an online health record at any time during the year to centralize your medical information in a secured site. You can share it with your doctors; track your prescriptions, preventive screenings and immunization needs; and otherwise monitor your health needs.

The three health plans offered to endowed faculty and staff are the Cornell Program for Healthy Living (CPHL), the Aetna Preferred Provider Organization (PPO) and the Aetna Health Savings Account (HSA). The Aetna PPO and CPHL offer similar coverages, but the CPHL offers an optional enhanced wellness exam, using specially contracted Ithaca-based primary care physicians, and other preventive and wellness benefits.

The HSA differs from the CPHL and Aetna PPO in how participants pay for care: The HSA plan has a high deductible but allows money to be saved in an account that earns tax-free interest as it grows over time. You draw from that account as needed to pay the plan’s deductible or any uncovered medical expenses.

All three plans exceed federal requirements and, for all full-time and most part-time employees, have financial advantages over the Affordable Care Act (ACA) and the new marketplace exchanges. To purchase a marketplace health plan, however, Cornell coverage must be terminated.

Endowed employees can realize tax savings by enrolling in medical and/or dependent care flexible savings account during the open enrollment period. The federal maximum amount for the medical care account is $2,500 per employee. The federal household maximum amount for the dependent care account is $5,000 (including any Cornell Child Care Grant amount you may have been awarded). The Medical Care Flexible Spending Account helps pay for medical expenses not covered by a health insurance plan, and the Dependent Care Flexible Spending Account helps pay for child care expenses. Recipients of a Cornell Child Care Grant whose grant award will cover their projected costs do not need to enroll in a Dependent Care Flexible Spending Account for 2014.

The annual Benefair will be held Nov. 13, 9 a.m.-3 p.m. at G10 Biotechnology Building. Staff from Benefit Services and other departments will be on hand to answer questions. More information: http://hr.cornell.edu/benefits/.

Media Contact

Get Cornell news delivered right to your inbox.

Subscribe